Unlocking $800k Through 3 Specialty Tax Strategies

Align Tax Consulting • December 10, 2024

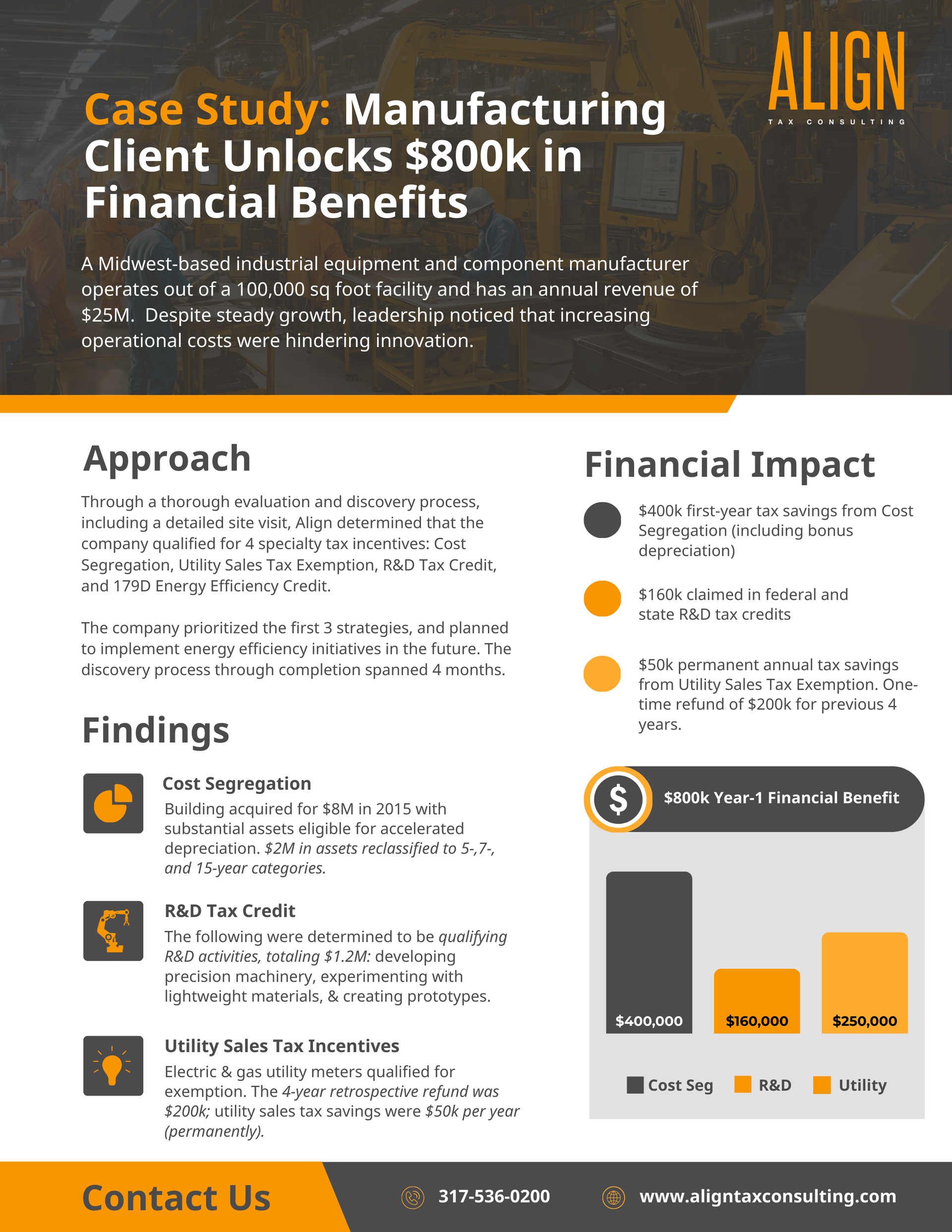

Midwest-based industrial equipment and component manufacturer operates out of a 100,000 sq foot facility and has an annual revenue of $25M. Despite steady growth, leadership noticed that increasing operational costs were hindering innovation.

Want to stay Tax Savvy?

Join our Newsletter!

Real estate investors planning to sell a property within a few years of acquisition or construction should understand how depreciation recapture affects their tax strategy. In this article, we’ll explain the basics of depreciation recapture and explore strategies to minimize its impact with the help of cost segregation experts and tax professionals.

Cost segregation may not yield immediate tax savings for all passive investors, but with thoughtful planning, it remains a highly effective long-term strategy. By understanding potential pitfalls—such as passive loss limitations—and seizing opportunities like future tax savings and portfolio-wide planning, passive investors can enhance their returns over time.