trusted advice. Simplified Solutions.

What is a Utility Sales Tax exemption?

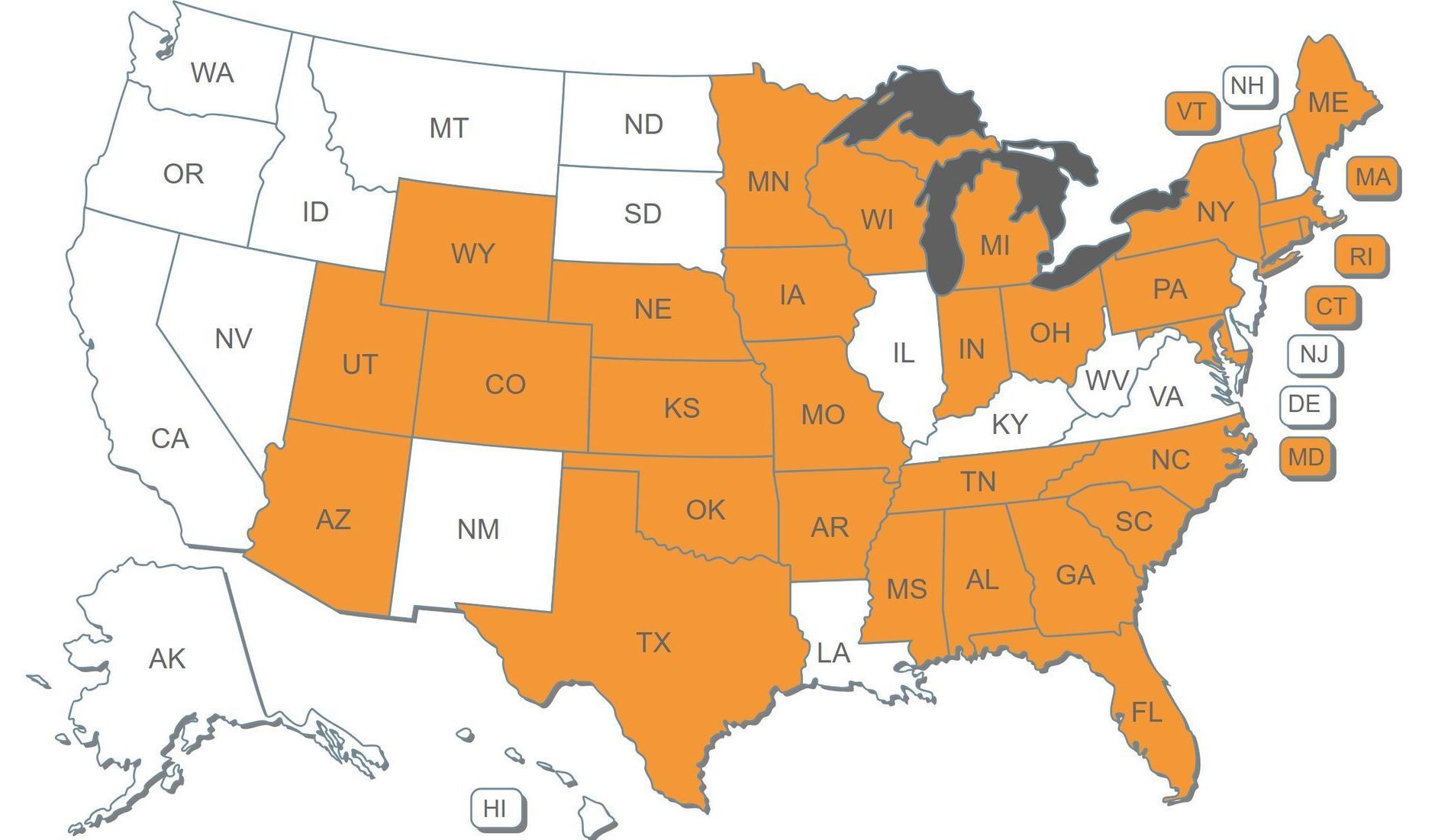

In 31 states, when utilities are “necessary and integral to production” a company does not have to pay sales tax on those utilities. The utility sales tax exemption is state legislation that is used as an economic incentive to encourage manufacturing and production within the state. Manufacturers are entitled to this exemption, and it could save your company substantial tax dollars moving forward.

Qualifying utilities include: electric, natural gas, water, steam, & industrial gases.

Align specializes in obtaining utility sales tax exemptions and refunds, and our process is straight-forward and requires minimal involvement from your team. We do the work - you benefit:

01

Estimate Savings

Our energy consultant team will quickly provide an estimate of tax savings based on a few of your utility bills

02

Engineering Study

We tour your facility. And through our engineering study, we determine what portion of production will qualify for an exemption

03

Submit Forms

Align submits all state required exemption forms. We also work directly with the state for any questions or in the case of an audit

04

Save Money

Once approved, your business will either reduce or eliminate monthly utility sales tax payments. In many states, this is a permanent exemption!

Frequently Asked Questions - Utility Sales Tax

What industries qualify for the exemption?

- Manufacturers

- Industrial Processors

- Recyclers

- Automated-Assembly Fabricators

- R&D Facilities

- Agriculture

- Mining Facilities

- Restaurants (select states)

- Nonprofit Organizations (select states)

Which utilities are included in the exemption?

- Electric

- Natural Gas

- Water

- Steam

- Industrial Gases

How much can we expect to save?

Expected savings depends on the state in which the facility is located.

Some states have what is called "Predominant Use" exemption. This means that as long as a certain percentage of the utility is used in production (typically 50% or 75%), the entire meter is fully exempt from sales tax.

Some states have a "Percent of Use" exemption. This means that however much the utility is being used in production, the sales tax on the meter is reduced by that percentage. For example, if Align's meter engineering study determines that the meter is used 65% in production, the monthly sales tax is reduced by 65%.

Under either scenario, the savings can be substantial. Our technical experts can determine with accuracy the exemption for which your facility will qualify.

Which states are eligible?

In the 31 orange states below, when utilities are “necessary and integral to production” a company does not have to pay utility sales tax. If you are in an orange state in a qualifying industry and you are paying sales tax on your utilities - you shouldn't be! We can help.

Interested in a Utility Sales Tax Estimate of Savings?

With just a few details, we can quickly estimate your potential savings!