Why Using a Trusted Cost Segregation Provider Matters

Federal tax strategies like cost segregation studies offer powerful ways to minimize tax liability, but their true value lies in their proper application.

Leveraging the tax code’s incentives for business reinvestment is essential for long-term success and profitability. Federal tax strategies like cost segregation studies offer powerful ways to minimize tax liability, but their true value lies in their proper application.

Given the complexity of tax regulations governing these strategies, expert guidance is crucial to fully unlock their potential while remaining compliant.

Below, we explore why selecting the right specialty tax provider is essential to maximizing profitability and ensuring long-term success.

Maximizing Tax Savings

A trusted cost segregation provider brings invaluable expertise to identify all available tax-saving opportunities that may otherwise be overlooked. For instance, an experienced provider can ensure that assets are classified into shorter recovery periods, accelerating depreciation and enhancing cash flow.

Additionally, an expert will apply deductions at the most beneficial time, aligning them with the taxpayer’s broader financial strategy. By collaborating with the tax preparer, they ensure the most effective timing and structure for deductions, maximizing savings at every opportunity.

Avoiding Costly Tax Traps

While specialty tax strategies can deliver significant savings, they also carry risks if not used correctly which can lead to increased taxable income, compliance issues, or even becoming usable. A trusted advisor will take the time to understand the taxpayer’s unique situation, asking the right questions to ensure strategies are implemented correctly. If a particular strategy cannot be applied, a reliable professional will be transparent and advise on the limitations. Having your tax preparer involved in the process when evaluating whether a cost segregation study is beneficial is always recommended.

A classic example is the “passive loss trap” for real estate investors. Rental income is generally considered passive unless specific requirements are met, and failing to meet those requirements can limit the ability to use accelerated deductions. A knowledgeable provider will advise if rental income can be considered active, helping ensure that proper documentation supports the taxpayer’s position. They will also make sure that any tax studies can be fully utilized, confirming there is income to offset accelerated deductions or that credits are available, regardless of the type of income generated from the business.

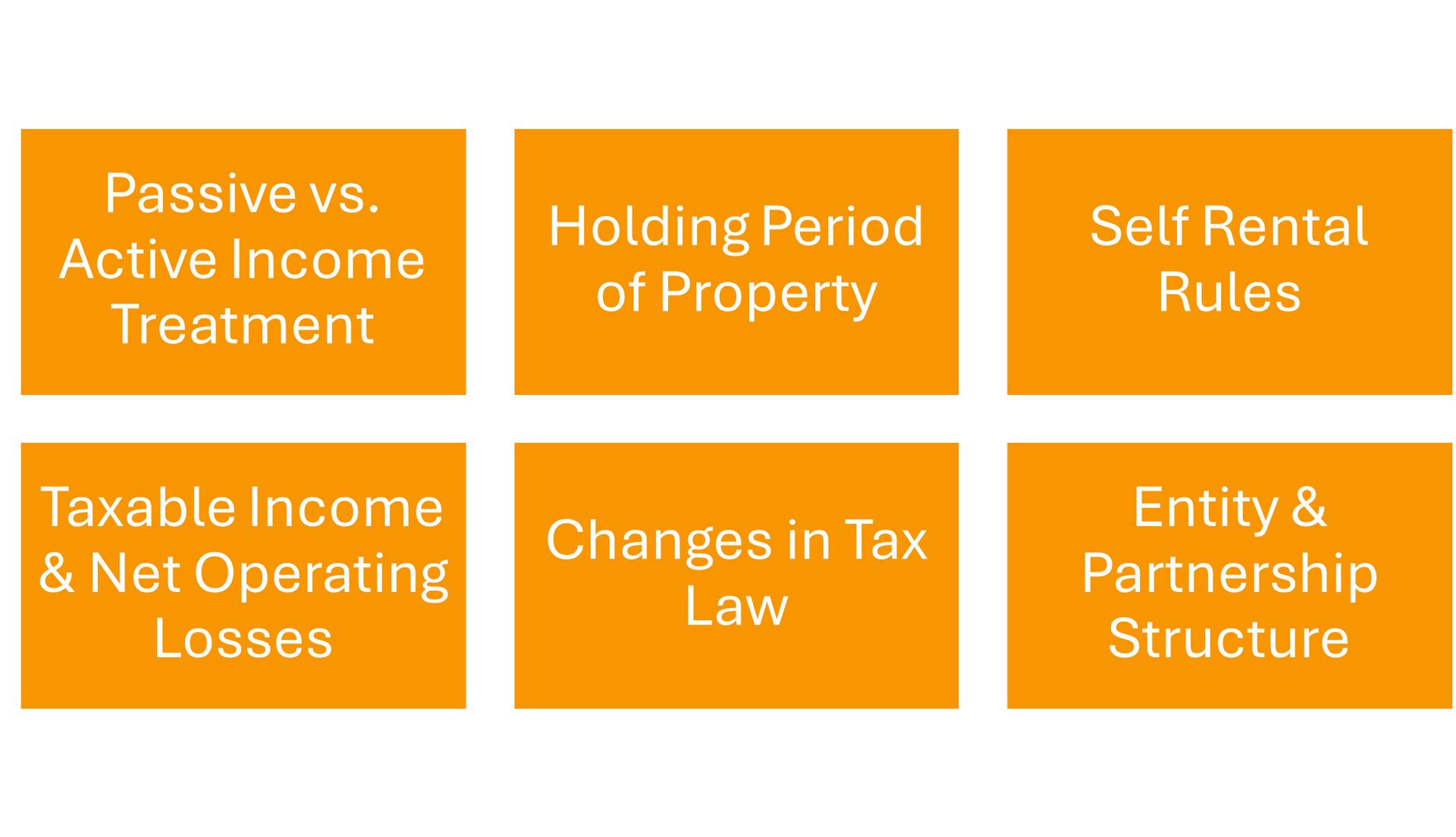

Some common elements that should be considered when preparing a cost segregation study are below:

Ensuring Compliance & Reducing Audit Risk

With the increasing demand for cost segregation services, the market has seen an influx of providers, many of whom lack the necessary experience to execute these studies properly. While the IRS fully supports cost segregation studies, they must be conducted in accordance with regulations.

The IRS Audit Techniques Guide (ATG) acknowledges that “there are no prescribed qualifications for cost segregation preparers,” yet a reputable provider will be transparent about their qualifications, credentials, and experience, assuring their ability to perform thorough, compliant studies that maximize benefits and minimize audit risk.

Failure to prepare a proper study can result in missed tax savings, IRS scrutiny, and costly audits. Misclassified assets or inadequate documentation can lead to disallowed deductions, increasing taxable income and resulting in penalties and interest charges. A quality provider will ensure every study complies with the ATG’s “Thirteen Principal Elements of a Quality Cost Segregation Study,” safeguarding against such risks. For example, a quality study includes a site visit to the property. If a provider completed a study without a site visit, then the taxpayer is at high risk if challenged by the IRS under audit.

When choosing a provider for cost segregation, ensure their report includes the following items:

Want to stay Tax Savvy?

Join our Newsletter!